The conclusion of the latest round of central bank meetings in the eurozone, UK and US offers us an opportunity to take stock of the recent action on currency markets and examine the outlook. Our forecast performance in July was reasonably strong, with GBP/EUR and GBP/USD ending at our month-end targets of €1.17 (Reuters consensus: €1.16) and $1.39 ($1.40), respectively. Granted we did see some more volatility than we had anticipated as the summer doldrums failed to arrive, with GBP/USD briefly testing below $1.36 and GBP/EUR under the €1.16 threshold in mid-July. To our credit, however, we had flagged in early July that a spike in Covid-19 cases on the back of the spread of the delta variant did represent a significant risk factor, particularly given current elevated growth forecasts.

Past performance is no guarantee of future performance, but recent messaging from central bankers and incoming macroeconomic data generally back our core view their sterling will test multi-year highs against both the euro and the dollar over a 12-month horizon:

Monetary Policy Divergence

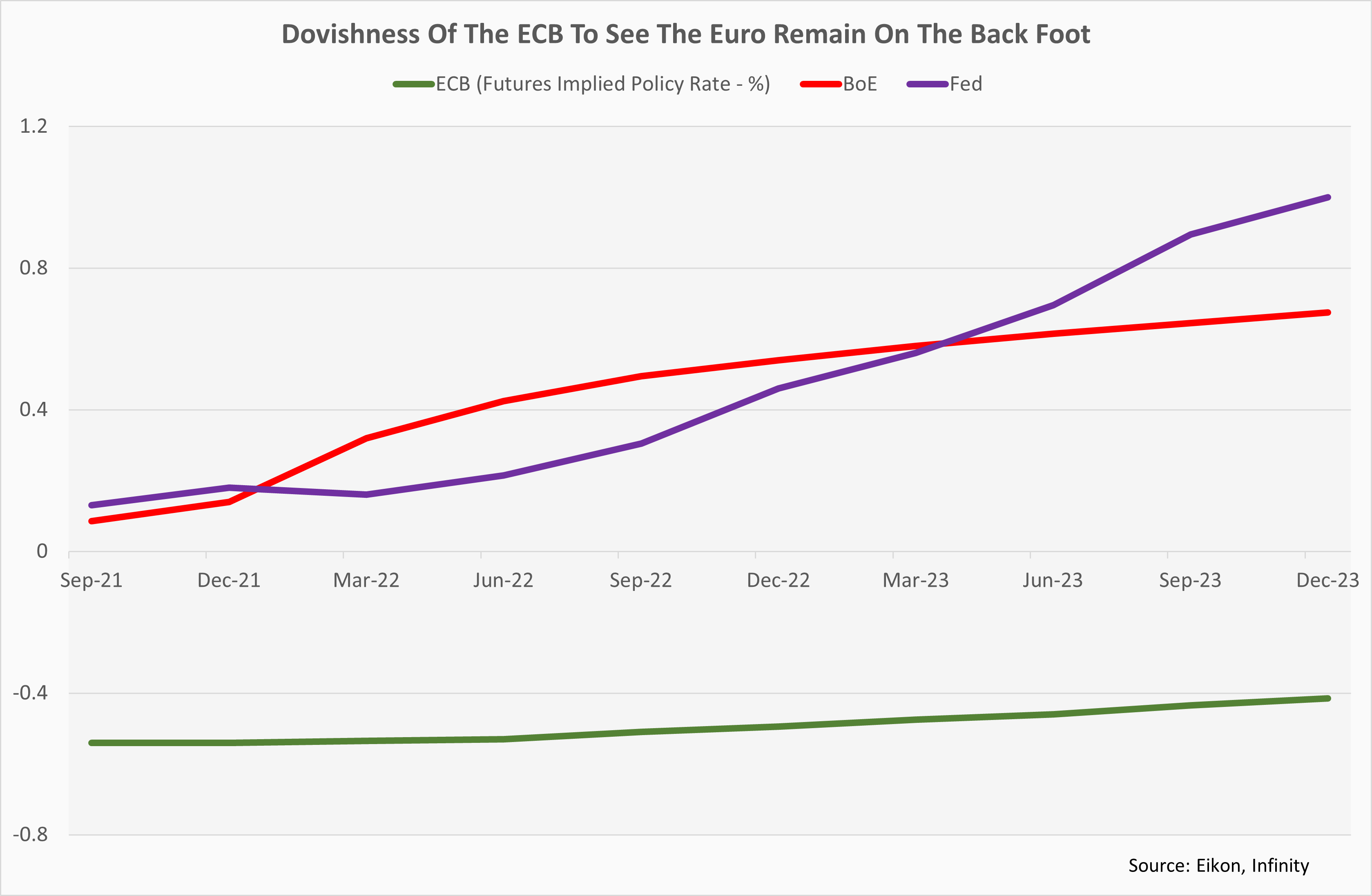

Central to our outlook is our belief that the Bank of England will move to raise interest rates ahead of the European Central Bank (given muted inflationary dynamics in the eurozone) and the US Fed (due to the central bank’s shift in policy stance last August which sees it place more emphasis on labour market conditions). The July/August round of central bank meetings offered support to this view, with sterling gaining last Thursday as the BoE indicated that some modest policy tightening would be necessary over its forecast horizon in order to prevent inflation holding sustainably above its 2% inflation target. In contrast, the ECB continued to guide that it will remain off the pitch for an extended period, which has seen eurozone bond yields drop sharply in recent weeks. Meanwhile, the Fed commented that while the economy had made progress towards the goals it wanted to see reached before it would taper its asset purchase programme, an incomplete labour market meant it was in no rush to begin the process.

Economic Data

In line with our view, macro data have generally not been a major mover of currency market action recently as growth has come in strong everywhere. To be fair, UK economic indicators pointed to a slowdown in July, as the ‘pingdemic’ hit hard. However, Covid cases have since moved off their peak (though they are stabilising at a still high level), self-isolation requirements are set to be eased on August 16 and consumer/business confidence survey data (GfK consumer sentiment index & Deloitte CFO survey) point to solid growth in the coming months. The last point tallies with our view that strong consumer spending is linked to an improving labour market & the wind-down of excess savings worth 10% of GDP, as well as a robust outlook for fixed investment now that Brexit uncertainty has cleared and on the back of the government’s super deduction scheme, will result in a supportive macro backdrop for sterling in the coming quarters.

Where we do some risks to our outlook is on the dollar front. US inflation is holding well above target (core PCE at 3.5% y-o-y in July), but the Fed has been reticent to talk about policy normalisation given that non-farm payrolls are still some 5.8mn below their pre-pandemic level. However, recent data suggest that a strong rebound is now underway, with payrolls having increased by above 900k in both June and July. Importantly, the apparently weak labour market recovery is a function of depressed labour supply rather than demand. Job vacancies are running at record highs, but enhanced jobless benefits and fear of the virus are encouraging workers to remain on the sidelines. Due to this distinction, it is difficult to make the case that an incomplete labour market recovery reduces the scope for inflation to rise sustainably, indeed average earnings growth has accelerated to 4.0% y-o-y in July as firms have raised wages to attract employees. As a result, we see increased scope for the Fed to raise interest rates before 2023 as we had initially envisaged, reducing the potential for cable to hit our 12-month target of $1.45 that we will be revising slightly lower this week.

Dollar

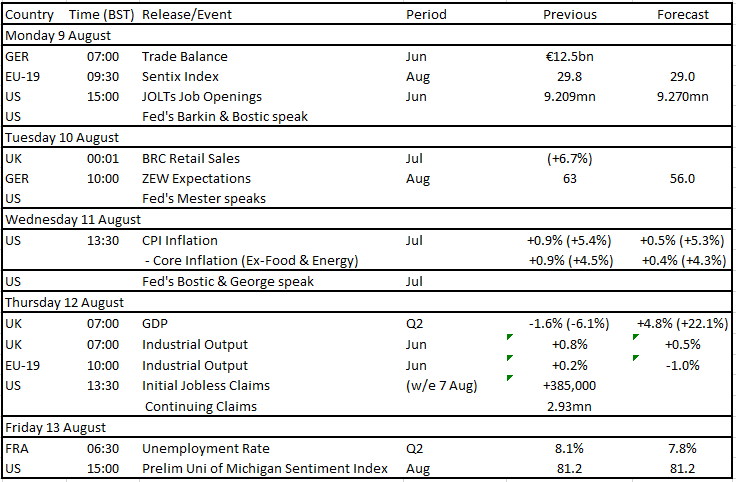

The focus in the US this week will be firmly on the US inflation report for July, with the data possibly set to heap further pressure on the Fed to begin dialling back policy support. To date, the central bank has guided that it will see through a period of elevated inflation that it views as transitory given the incomplete labour market recovery. However, employment data have begun to improve markedly, with circa 900k jobs created in both June and July. Granted non-farm payrolls were still 5.8mn below their pre-pandemic peak in July, but with job vacancies running above 9mn in May, it is difficult to make the argument that the labour market is not running on the right side. Indeed, wage inflation is picking up sharply, with the y-o-y rate registered at 4.0% in July, a prerequisite for sustainable price growth.

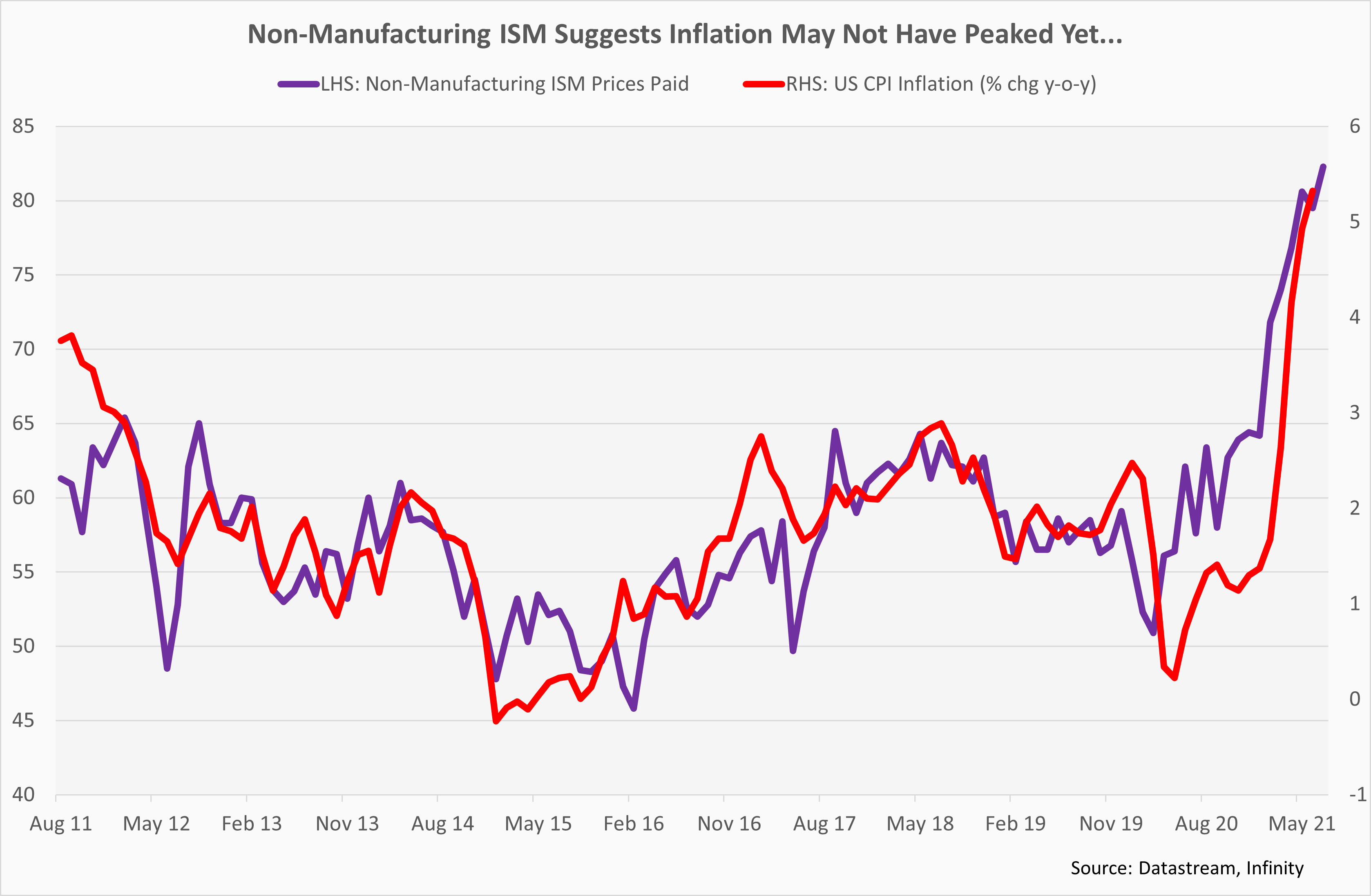

As a result of the improved labour market backdrop, if we fail to see some easing of inflationary pressures in July’s CPI figures, it will become more difficult for the Fed to remain off the pitch and a tapering of the central bank’s asset purchase programme before year-end may re-emerge as a possibility. Consensus, however, is looking for a deceleration in the headline rate of inflation to 5.3% y-o-y from 5.4%, backed by evidence that used car prices (which accounted for one-third of the surge in annual inflation in both May and June) have now peaked. We also expect to see signs of a slowdown but note that the prices paid subcomponent of the non-manufacturing ISM rose to its second-high level on record in July. This in turn could result in an upside surprise this week, resulting in the dollar extending on Friday’s gains.

Staying on the inflation front, markets will also look to the preliminary print of the University of Michigan’s consumer sentiment index for August to see whether household expectations are drifting higher. While households consistently overestimate the actual level of inflation, they have a solid track in identifying shifts in inflation regimes (indeed they are self-fulfilling). Any sign of a further uptick will cause some consternation within the Fed as a result. In the lead-up and aftermath of the releases, we will be closely tracking speeches by several officials for any evidence of a change in view in light of the latest data.

Sterling

In the UK, attention will be focused on the first estimate of Q2 GDP, though the data are not typically a mover for sterling given their lagging nature. Consensus is for a 4.8% q-o-q expansion in the month, driven by a strong rebound in consumer spending as the UK’s effective vaccine rollout saw the economy largely re-open in the quarter and paved the way for the release of pent-up demand. Business investment is also likely to have made a positive contribution to growth, though it may have been held back somewhat by the emergence of major supply-side issues. As we have highlighted in a recent weekly, we believe growth lost momentum in July as the ‘pingdemic’ hit. However, we see scope for a re-acceleration in August as UK Covid cases have subsided and self-isolation requirements will be eased on August 16, which should offer some upside to sterling.

Euro

There is once again a quiet calendar in the eurozone, with the only item of any interest on the calendar being the June print of industrial production. However, the data will attract minimal attention from an FX perspective given that they lag both the release of national data for the same month. As elsewhere, output growth is being held back by supply chain disruptions, such as a shortage of semiconductors and limited shipping capacity.

This blog post is intended to provide you with information on the services Lumon Pay Ltd (“LPL”) offer and should not be interpreted as advice or as a solicitation to offer to buy or sell any currency or as a recommendation to trade. Foreign exchange rates provided therein are for indicative purposes only and are not intended to give an accurate reflection of current currency exchange rates or to predict future movements in currency exchange rates. LPL, trading as Lumon, is a company registered in England with its registered address at Building 1, Chalfont Park, Gerrards Cross, Buckinghamshire SL9 0BG. LPL is authorised by the Financial Conduct Authority as an Electronic Money Institution (FRN: 902022).