The pound hit a fresh 20-month high against the euro today as the pairings draws ever nearer to 1.19. For clients who follow the market, before the pandemic back in February last year the currency pair stood at 1.20 which then witnessed COVID-19 in March pulling rates down to almost parity which was a multi-year low.

With rates rising, this is in the lead up to the tomorrow’s budget announcement where they have already set plans to raise the national minimum wage and adjust universal credit limits. So far, this news has a subdued effect on sterling but could see increased volatility on Wednesday following the actual meeting. This should be an event for investors looking to buy or sell pounds to watch out for, as historic trends have shown that on-the-day movements can be larger than usual if there is a shock to the market such as figures coming in away from expectation which was factored into the markets.

Rates have also moved to pre-pandemic levels based off the hotly disputed topic of the interest rate hikes that have been proposed by the Bank of England. As had been mentioned in prior market reports recently, initial forecasts put this increase to occur around August next year, which was then revised to June next year and now could be as soon as November. This is significant as very few countries have made the decision to hike rates this early into their recovery. Norway is one of the few countries to do this as the UK could well join them in moving away from the current historic low of 0.1%.

In other commonly traded currencies, the pound is not doing as well against the US dollar. Resistance levels which had been around 1.38 have now fluctuated and interbank exchange rates now have fallen to as low as 1.3750. In fairness to the pound, this was more to do with US dollar strength which will be reviewed in the USD section.

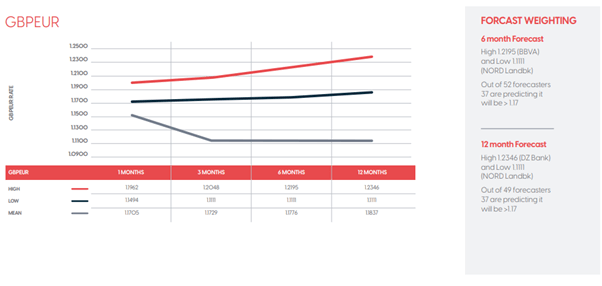

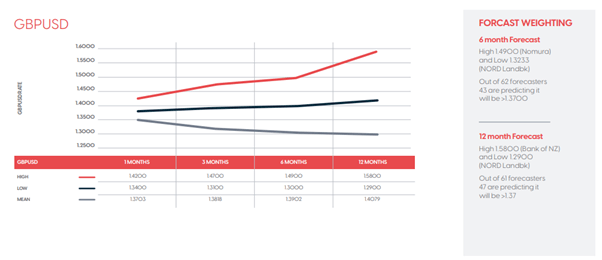

However, most investment banks and larger financial institutions are predicting GBP/EUR and GBP/USD rates to improve long term. As the below graphs show, 37 out of 52 banks are expecting rates to continue to improve for GBP/EUR whilst GBP/USD, also referred to as Cable or the Greenback, is expecting to see some faster gains. Some predictions even go as far to suggest that GBP/USD cold even get close to 1.50 in the next 6 months.

It is worth bearing in mind that these are simply just predictions and is not guaranteed to move to these levels, but it does suggest a general trend that the pound is expecting to continue climbing.

On a separate note, there is very little economic data releases of consequence this week in the UK and will not have anything until next Thursday when the Bank of England releases its interest rate decision and its monetary policy stance moving forward into next year.

Euro continues to weaken amidst its issues with stagflation

Within Europe, the single currency does not have much market data to rely on as it continues to weaken against a basket of G10 currencies. Nothing sizeable will arrive today or tomorrow but towards the end of the week there will be the European Central Bank Interest rate decision on Thursday which is accompanied by the German GDP Q3 release on Friday. Since the eurozone does not have much scope to hike interest rates near-term, the euro cannot benefit as much as the pound can and the markets believe that there will be no change from the 0% levels. This correlates to a term called stagflation. This is where unemployment and stagnant growth are mixed in with rising inflation to create a scenario where the cost of living rises faster than salary and can put many people into poverty and increased homelessness. The ECB may need to look at their monetary policy stance to regain some economic balance before this issue worsens.

On a more positive note, the German GDP release is more optimistic as the previous 1.6% is predicted to rise to 2.2%. There are few better countries in Europe to receive positive economic recovery figures than Germany since it is the financial powerhouse of the Bloc and makes up a substantial proportion of overall GDP. If the 2.2% outcome or above is correct, you would expect the euro to gain in value to recover some of its lost ground to the pound./

USD continues to make inroads against the euro

Whilst GBP/USD has been relatively rangebound within a couple of cents over the last few months, EUR/USD does not share the same pattern. With the euro weakening and the USD strengthening, the pairing, if buying USD, is now 6 cents better than 6 months ago with the latest mid-market levels trading in the 1.16’s.

The dollar has done well in a similar way to which the pound has as its central bank, the Federal Reserve, has plans for two interest rate hikes next year to check the rising inflation that has been seen in the States. With a very positive outlook ahead in terms of economic recovery, the US dollar continues to strengthen.

Later this week on Thursday, the all-important GDP Q3 release will also arrive and could give reason to halt the dollar rising further. The previous quarter’s recording was 6.7%, a very impressive gain considering how many economies ,globally, are doing and this quarter is planned to fall sharply to just 2.5%. Whilst this is still positive growth, it would decelerate heavily and since GDP is an overall gauge as to how a country is doing financially, this could cause issues for the currency in question. Thus, it is worth keeping an eye on this release should you be in the market for dollars.

Should you have an upcoming transfer to make this week, please reach out to your account manager here at Lumon, for an update to date review of your trading position.

This blog post is intended to provide you with information on the services Lumon Pay Ltd (“LPL”) offer and should not be interpreted as advice or as a solicitation to offer to buy or sell any currency or as a recommendation to trade. Foreign exchange rates provided therein are for indicative purposes only and are not intended to give an accurate reflection of current currency exchange rates or to predict future movements in currency exchange rates. LPL, trading as Lumon, is a company registered in England with its registered address at Building 1, Chalfont Park, Gerrards Cross, Buckinghamshire SL9 0BG. LPL is authorised by the Financial Conduct Authority as an Electronic Money Institution (FRN: 902022).