Dollar

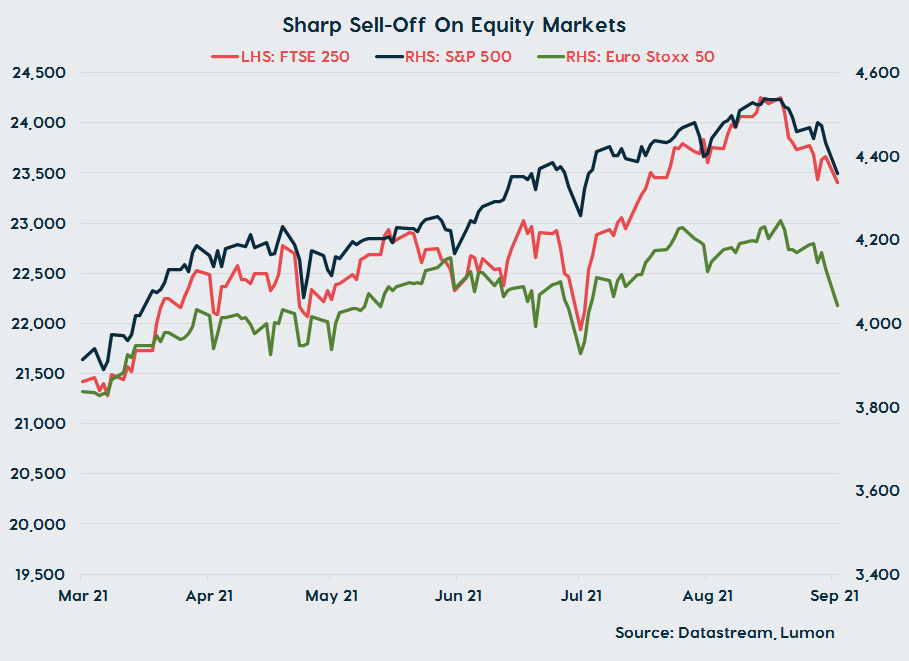

The dollar saw good support yesterday as investors remained firmly in risk-off mode. This saw GBP/USD break back below the $1.37 threshold, while EUR/USD held within the $1.17-1.18 range. We have flagged in our monthly FX pieces that equity valuations appeared rich, with the outlook for growth deteriorating relative to lofty expectations and had guided that a sudden loss of confidence could feed across into greenback strength. The pandemic has proved more persistent than had been initially anticipated thanks to the spread of the delta variant of COVID-19, while supply chain disruptions are weighing heavily on production and pushing prices higher globally.

All the while, China is undergoing a fundamental realignment as the government has sought to tackle excess in the highly leveraged property sector, while simultaneously launching a regulatory crackdown in the tech industry. It is the former that appears to be driving the current bout of risk aversion, with traders watching for potential spillover effects following the collapse of Evergrande, China’s second-largest property developer.

Today investor sentiment remains fragile, which could mean that the dollar will remain on the front foot. US equities did rally into the close yesterday evening, but Japanese and Chinese equities sold off sharply overnight. Looking further ahead, the safe bet is that we are amid a modest pullback rather than at the cusp of a financial sector meltdown, with abundant liquidity stemming from the central bank’s asset purchase programmes helping to prevent a sustained collapse in equity prices.

That said, it may be the case that we do not see a turnaround on markets in the lead-up to tomorrow night’s Fed meeting, given the risk of a hawkish outcome. The central bank appears unlikely to announce a tapering of its asset purchases, reflecting evidence of a slowdown in economic activity in Q3 on the back of a surge in Covid-19 cases, driven by the spread of the delta variant. However, there are some concerns that officials may signal that they expect interest rates to rise as early as next year, as strong wage inflation suggests that the labour market may be tighter than the headline unemployment rate suggests, and inflation expectations continue to push higher.

Sterling

As is typical during a period of risk aversion, sterling has come under relatively significant pressure in the past few days, with GBP/EUR dropping down to the midpoint of the €1.16-1.17 range. As we have highlighted, this reflects sterling status as a ‘high beta’ currency, owing to its sizeable trade deficit financed via capital inflows. We anticipate that sterling will remain on the back foot until we see investor sentiment begin to improve, though a hawkish outcome to Thursday’s BoE meeting could also help the UK currency regain the lost ground. Of particular interest will be whether the central bank votes to prematurely end its QE programme (currently due to run until end-December), given recent hawkish comments from policymakers and growing upside risks (most recently in the form of spiking gas prices) to the central bank’s forecasts for inflation to touch 4% in Q4.

Euro

Over in the eurozone, there is a quiet look to the macro schedule today, suggesting that the euro could struggle for direction. Despite the region’s relatively large exposure to China (via trade), the single market currency has weathered this week’s sell-off reasonably well. However, we anticipate that it will act as a drag over the medium-term as it contributes to a softening of eurozone output growth.

This blog post is intended to provide you with information on the services Lumon Pay Ltd (“LPL”) offer and should not be interpreted as advice or as a solicitation to offer to buy or sell any currency or as a recommendation to trade. Foreign exchange rates provided therein are for indicative purposes only and are not intended to give an accurate reflection of current currency exchange rates or to predict future movements in currency exchange rates. LPL, trading as Lumon, is a company registered in England with its registered address at Building 1, Chalfont Park, Gerrards Cross, Buckinghamshire SL9 0BG. LPL is authorised by the Financial Conduct Authority as an Electronic Money Institution (FRN: 902022).